Any tcf bank Business Edition Visa Cardholder can sign up for the online access service and have their way in terms of managing their account online. It is simple if you know what to do. However, new users will need assistance when it comes to how to log in, how to get their login details if forgotten and how to enroll.

How to login

The easy part is when it comes to logging into your account. All you need to know is your user ID and password. From there, you can proceed to access your account. However, it can be a little bit challenging at first since you are not used to it. To get you up to speed with this, use the procedure below:

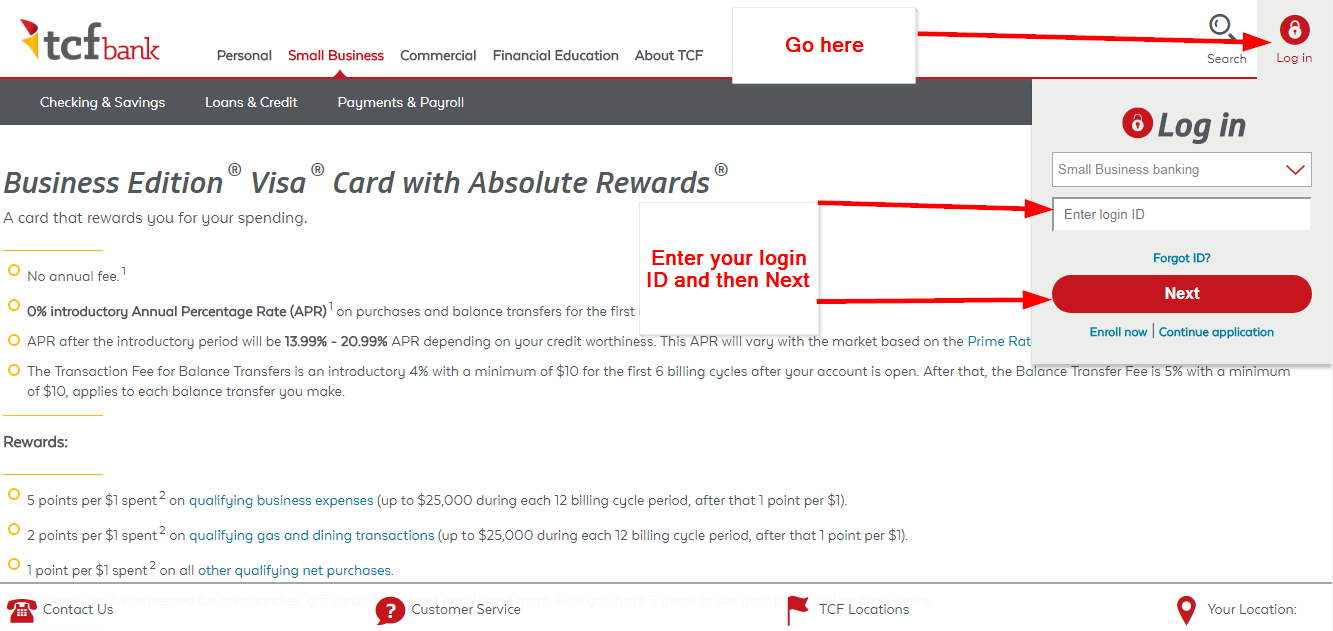

Step 1: Click here

Step 2: Tap the login button, select account type, enter your login ID and then click Next

How to get your user ID or password if forgotten

The downside is when you cannot remember your login details. You may be in a hurry to enter your login details and miss out on a character in your password details. However, with a second trial, it may fail again. This is when you have to retrieve your login details in order to regain access to your account. Use the steps as follows:

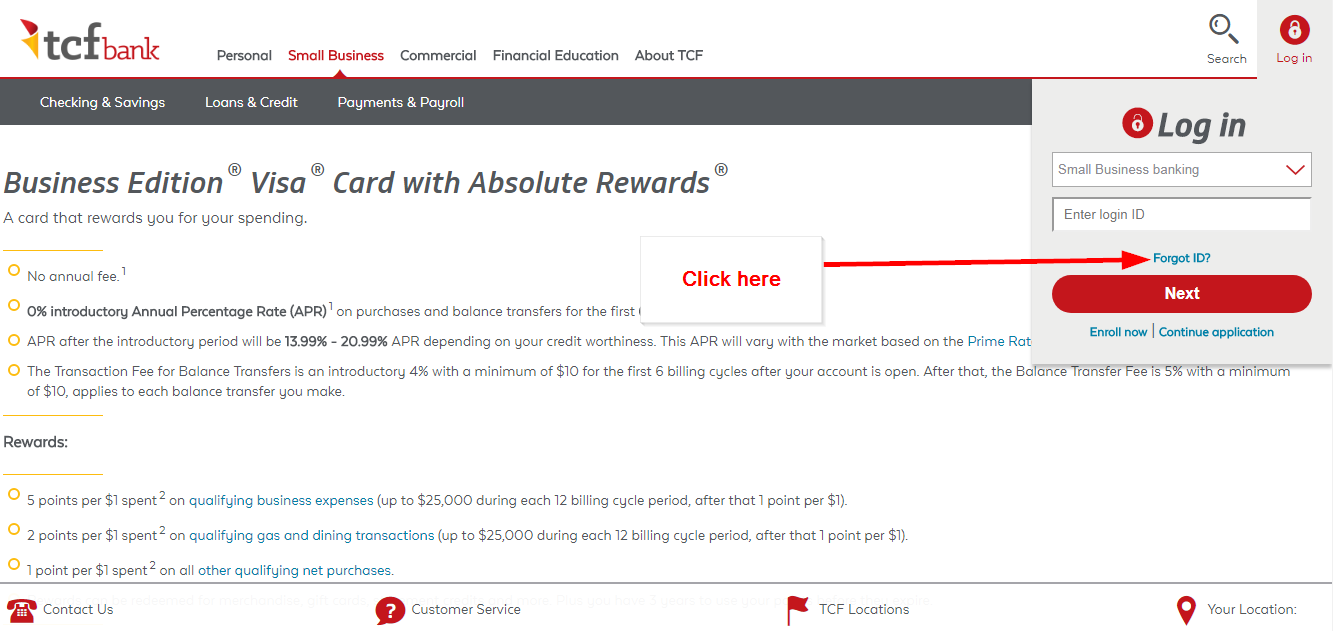

Step 1: Click the forgot ID phrase.

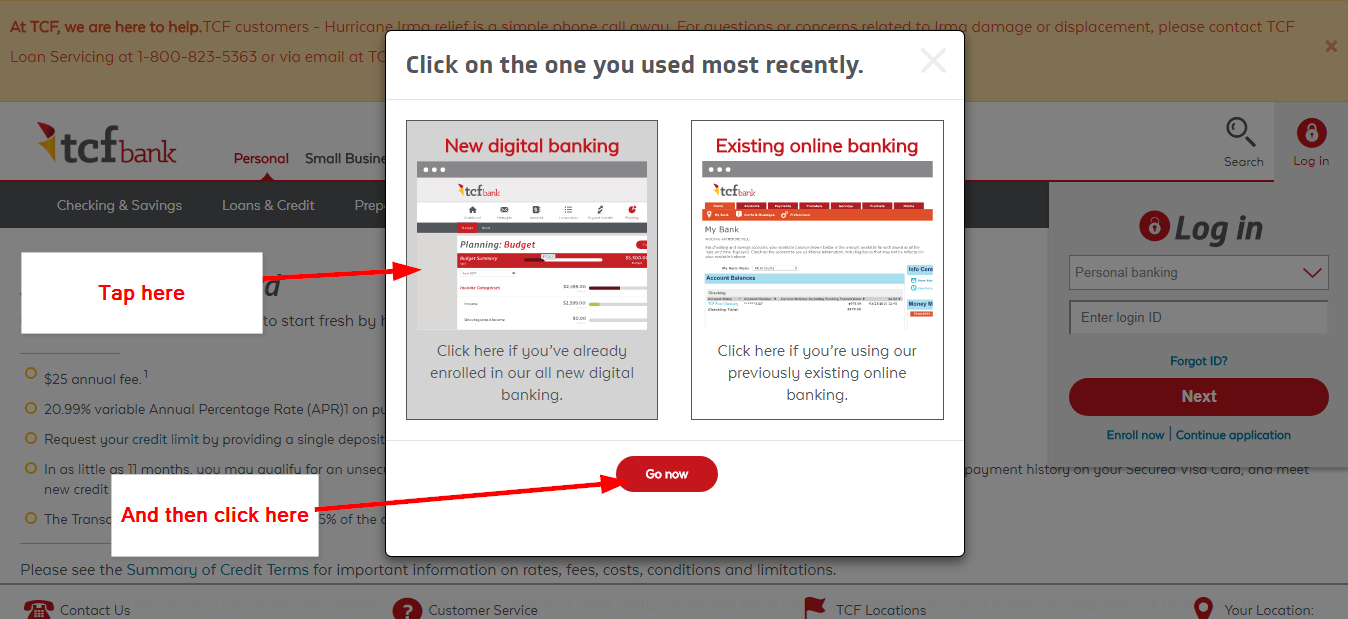

Step 2: Select as required and then tap the Go Now button.

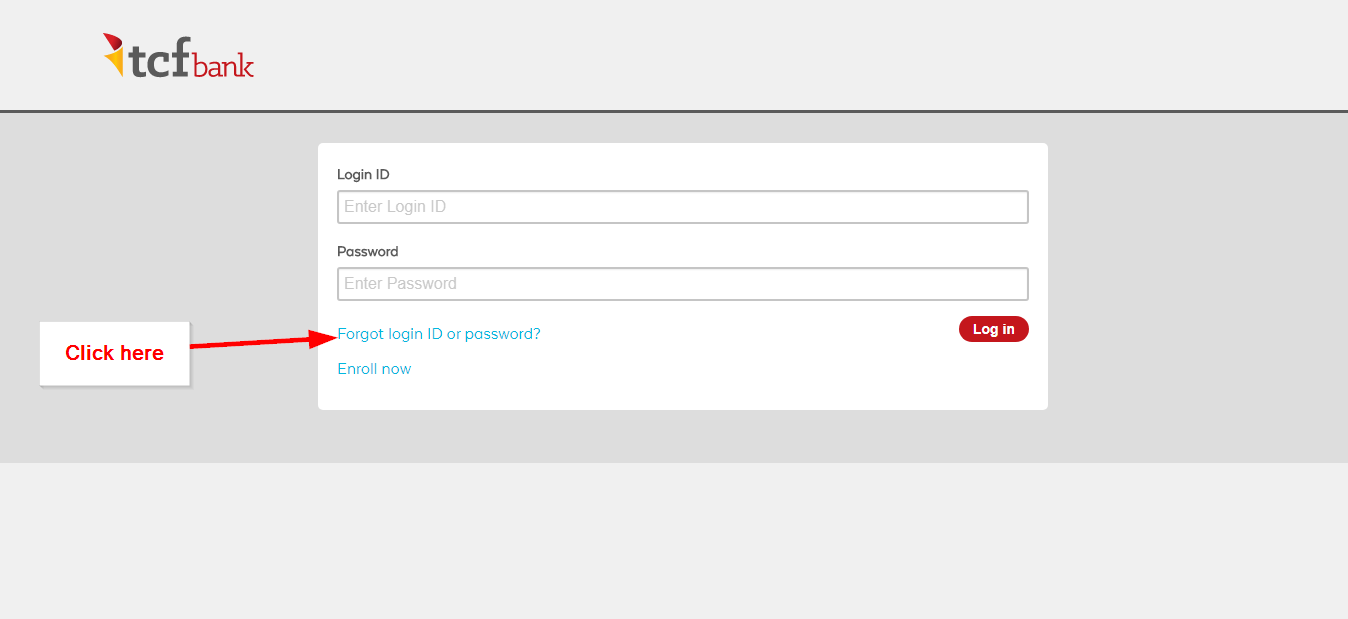

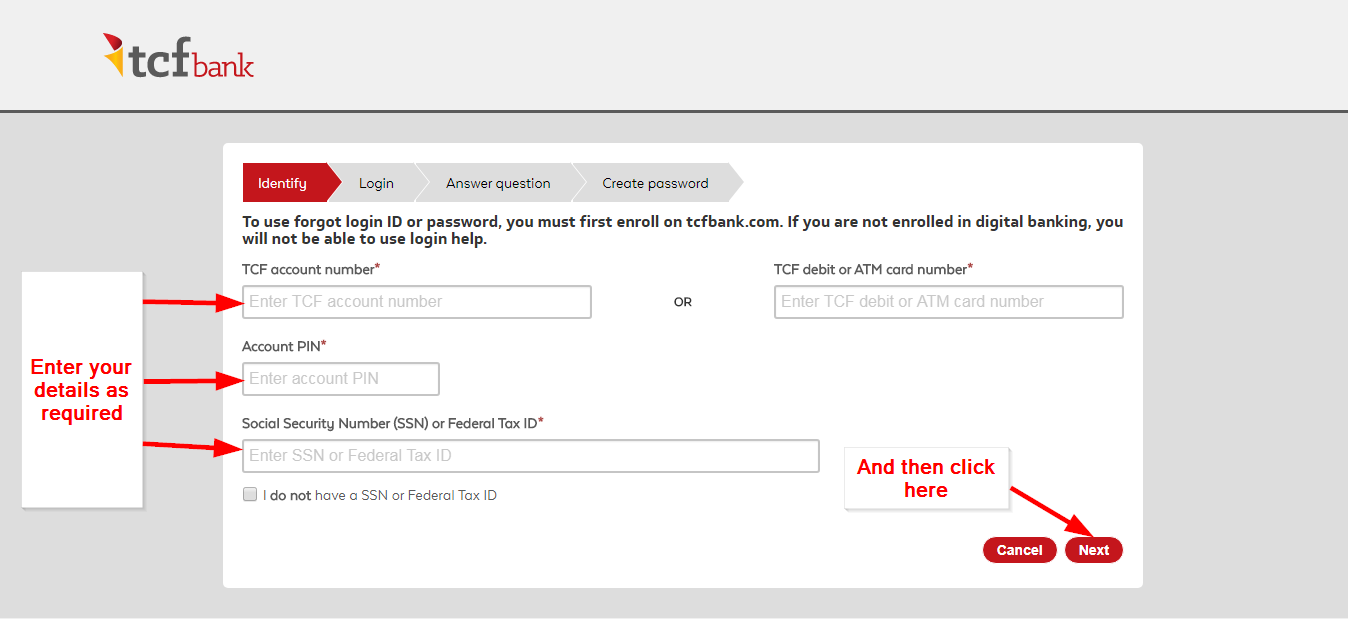

Step 3: Click the forgot login ID or password phrase.

Step 4: Enter your account number, card number, PIN number, social security number and then tap Next.

How to enroll

The role of your login account is defined by this process. You have to go through this hurdle if you want to enjoy 24/7 access to your account. It helps you to create a user ID and password details for ease of access to your account online. The process involves:

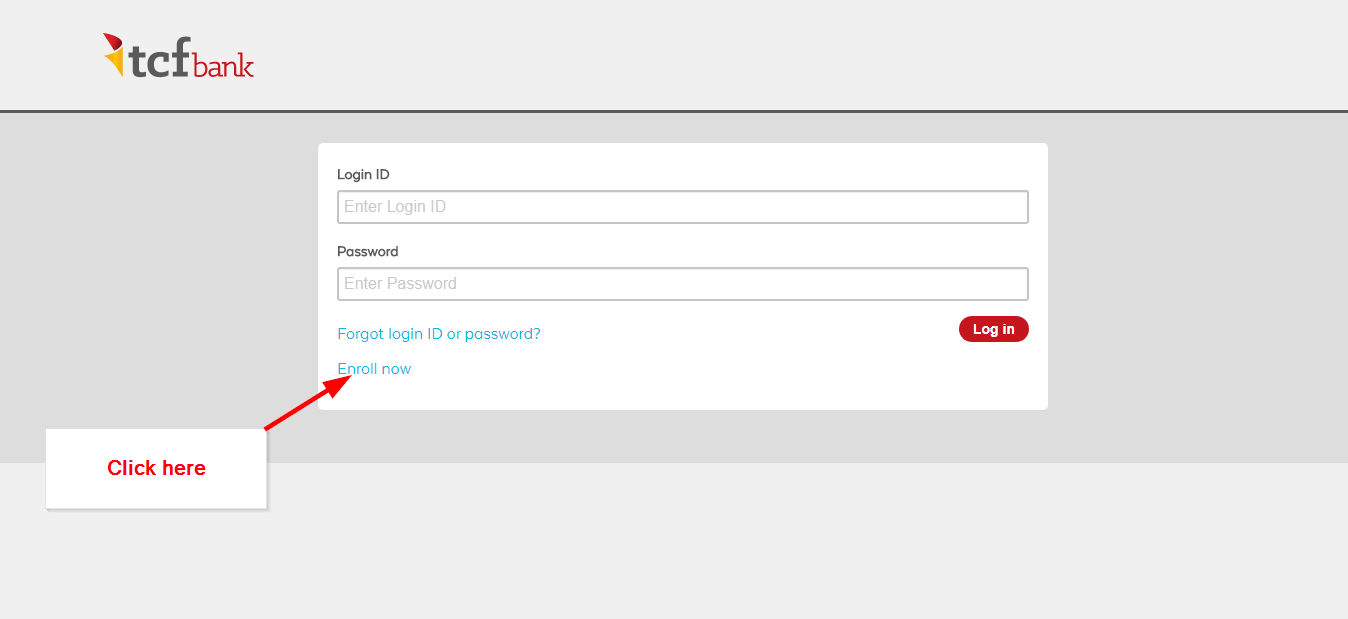

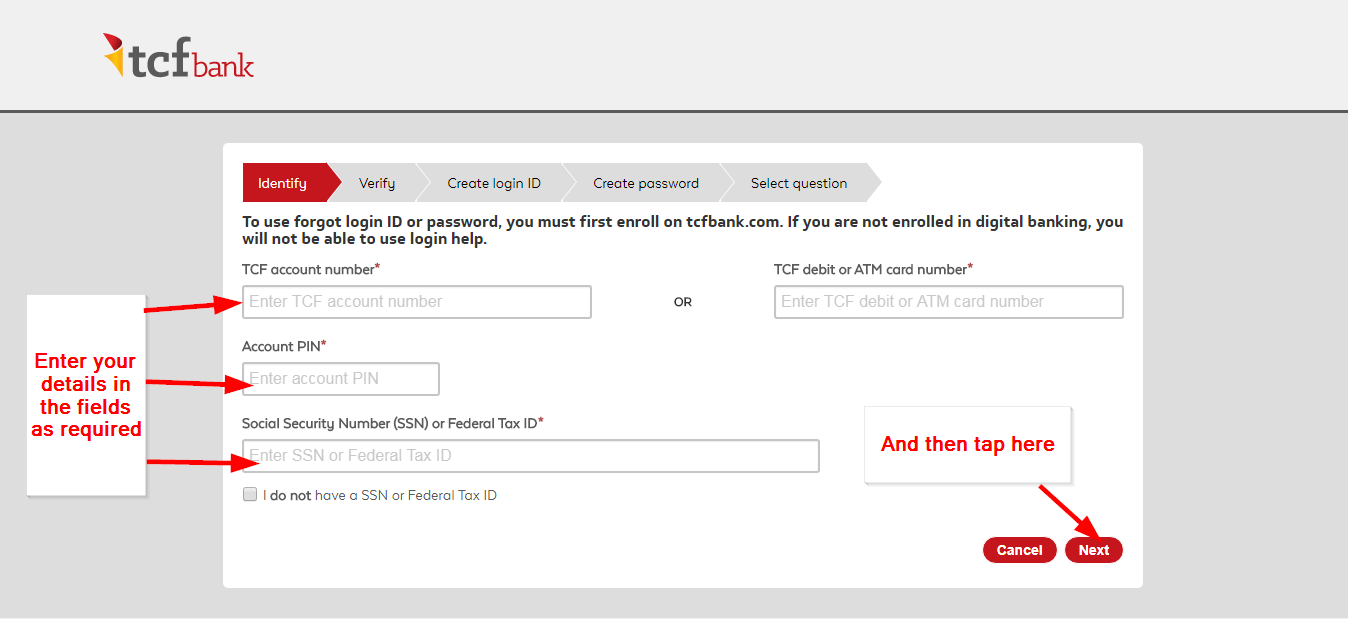

Step 1: Click the enroll now button.

Step 2: Enter your account number, card number, account PIN, and social security number and then tap Next.

How to manage your credit card account online

As soon as your account is verified, you can proceed to login. There are many benefits you can enjoy from this. To start you off, you will be able to keep track of all your bonus points, credit score and balance. On top of that, you can pay bills before the due date and thus save your credit score on the same.