Established in 2004, 1st Trust Bank has invested in both technology and professional human resources with the sole aim of providing superior customer service. It is headquartered in Hazard but has additional branches in London and Richmond to serve more customers as its clientele as its customer-base has grown over the years.

- Branch / ATM Locator

- Website: https://www.1sttrustbankinc.com

- Routing Number: 042108449

- Swift Code: Not Available

- Mobile App: Not Available

- Telephone Number: (844) 435-2265

- Headquartered In: Kentucky

- Founded: 2004 (20 years ago)

- Bank’s Rating:

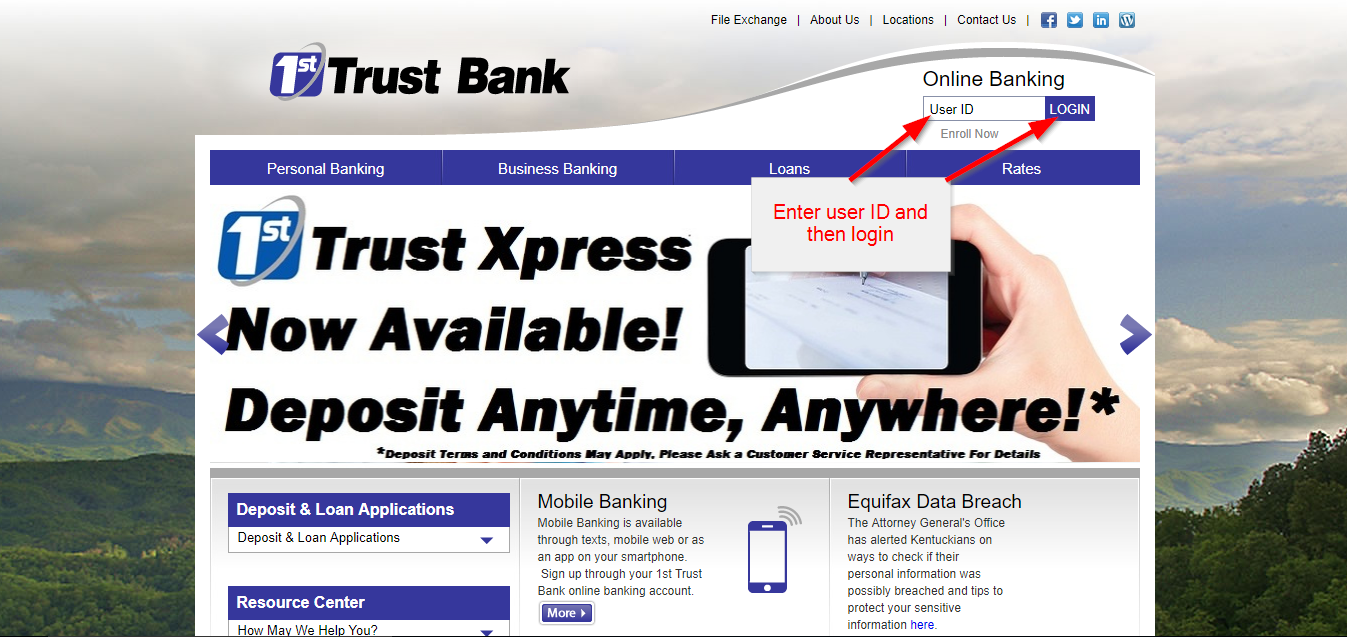

HOW TO LOGIN

You can access your account within a few minutes. However, the speed with which you access it will depend on whether you are familiar with the process and you remember your login details. To start off things, use the following steps to access your account:

Step 1: Click here

Step 2: Enter your user ID and then login

In the next pages, you will have to verify your account before you can enter your password to successfully access your account.

HOW TO GET YOUR PASSWORD AND USERNAME IF FORGOTTEN

Forgetting your login details has never been a foreign thing. It not only happens to new users but also existing ones. It may be that you have recently changed your password and you happen to forget the new password. To get your login details, call 606-435-2265 for help.

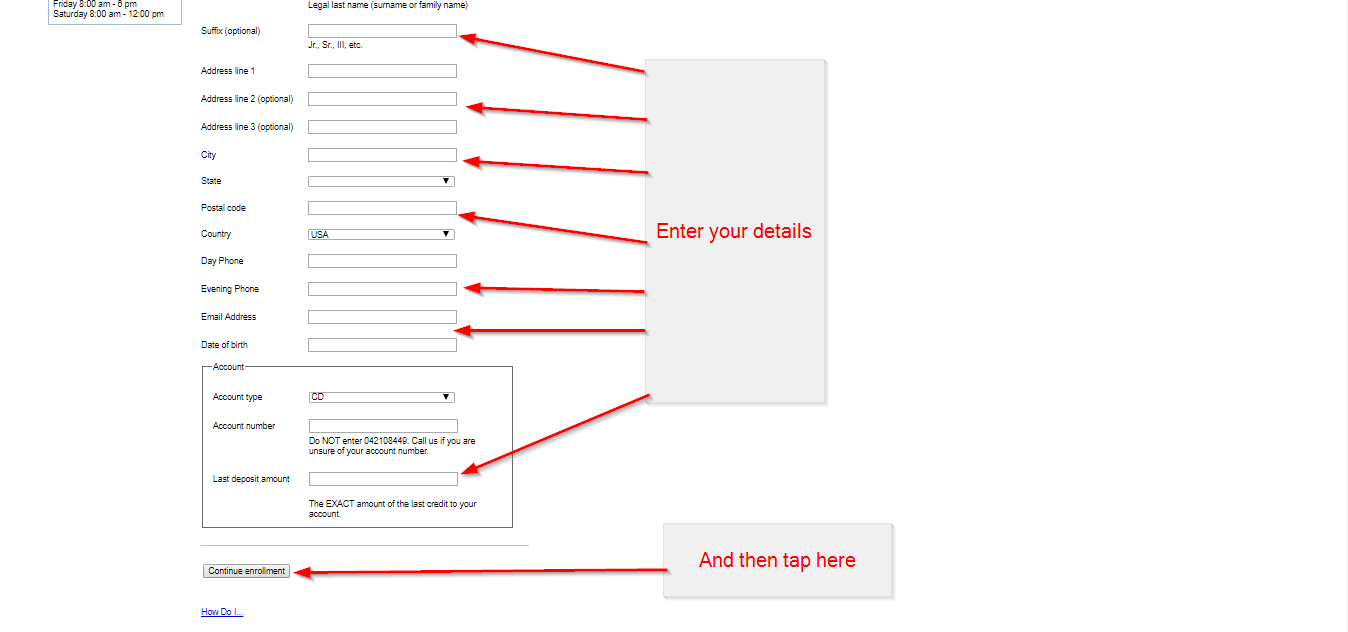

HOW TO ENROLL

It is a grave thing to decide whether to register your account for online access or not. Most people who are not familiar with how the online platform works will have second thoughts due to the fear of security on the internet. However, 1st Trust Bank offers a guarantee for a safe and secure online banking platform. You can enroll safely using the following steps:

Step 1: Click the enroll now phrase

Step 2: Enter your details as required and then continue enrollment to complete the process.

HOW TO MANAGE YOUR BANK ACCOUNT ONLINE

It is the ultimate goal for anyone looking to have financial and banking flexibility. With the never-ending activities of the day which can be hectic to manage, you need a service that allows you to access your bank account regardless of where you are. This way you will be able to make payments when they are due and check your loan limit while you apply for another one.